EvolvaAI works with Enterprises, Agencies and Generative AI companies

Intelligent Insurance for a Modern World

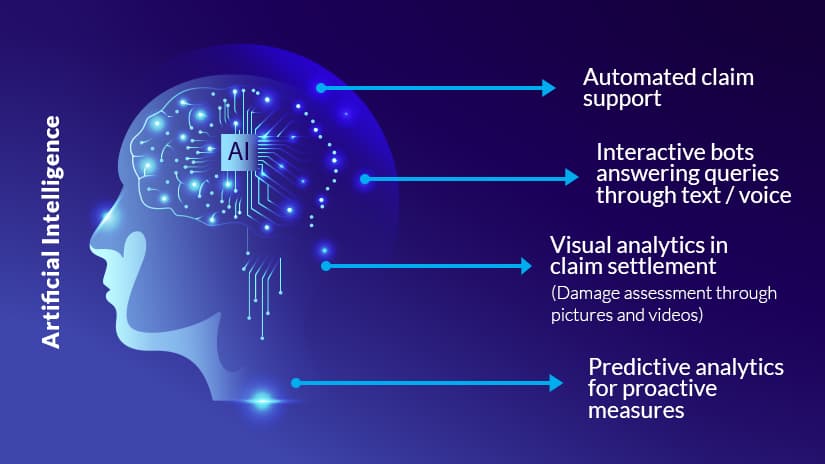

Artificial intelligence is reshaping the insurance landscape by enabling data-driven risk assessment, automating complex processes, and delivering hyper-personalized customer experiences.

Automated Underwriting

AI algorithms analyze vast datasets to assess risk and determine premiums with greater accuracy and speed.

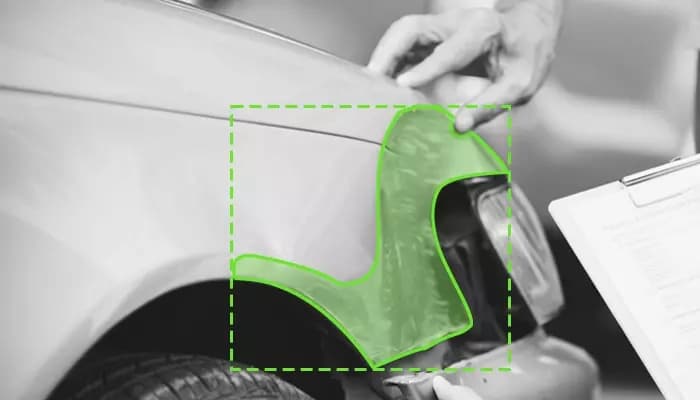

Streamlined Claims Processing

Automate claims intake, fraud detection, and damage assessment for faster, more accurate resolutions.

Personalized Customer Experiences

Tailor insurance products and recommendations to individual customer needs and behaviors.

AI-Powered Solutions for the Insurance Industry

Evolva AI offers a suite of solutions designed to address the most pressing challenges in the insurance sector.

Predictive Analytics for Risk Modeling

Utilize AI to analyze historical data and predict future risks, enabling more accurate pricing and underwriting.

AI-Powered Claims Automation

Automate the entire claims lifecycle, from first notice of loss to settlement, for faster and more efficient processing.

Fraud Detection and Prevention

Identify and flag suspicious claims in real-time, reducing financial losses due to fraud.

Personalized Insurance Products

Leverage customer data to create and recommend tailored insurance products, such as usage-based insurance.

Enhanced Customer Service with Chatbots

Deploy AI-powered chatbots to provide 24/7 customer support, answer policy questions, and assist with claims.

Automated Policy Document Analysis

Use NLP to extract and analyze information from complex policy documents, reducing manual effort and errors.

Driving Insurance Innovation

Evolva AI partners with insurance carriers, brokers, and insurtech companies to build and deploy cutting-edge AI solutions that deliver tangible results and enhance customer satisfaction.

Improved Underwriting Accuracy

Enhance risk assessment and pricing for better profitability and market competitiveness.

Increased Operational Efficiency

Streamline workflows, reduce manual tasks, and accelerate claims processing to lower operational costs.

Enhanced Customer Engagement

Deliver personalized experiences and faster service to improve customer loyalty and retention.

A Data-Driven Path to Insurance Excellence

Our structured methodology ensures the successful and ethical integration of AI into your insurance operations.

1. Needs Assessment & Strategy

Identify specific challenges and opportunities for AI implementation in your insurance business.

2. Data Integration & Preparation

Securely gather and prepare diverse insurance data (claims, policies, customer interactions) to build robust AI models.

3. Model Development & Validation

Develop custom AI models and rigorously validate them for accuracy, fairness, and regulatory compliance.

4. Integration & Continuous Monitoring

Seamlessly integrate AI solutions into your existing systems and continuously monitor their performance and impact.

Pushing the Boundaries of Insurtech AI

Evolva AI is at the forefront of insurance innovation, offering advanced AI capabilities to address the most complex industry challenges.

Behavioral Science & Risk Profiling

Analyze behavioral data to create more accurate risk profiles and encourage safer habits.

AI for Catastrophe Modeling

Utilize AI to predict the impact of natural disasters and climate change on underwriting and portfolio risk.

Dynamic Pricing & Policy Adjustment

Implement real-time pricing models that adjust premiums based on changing risk factors and customer behavior.

Natural Language Processing for Underwriting

Extract insights from unstructured data sources like medical records and social media to enhance risk assessment.